What Is a Fiduciary Bond?

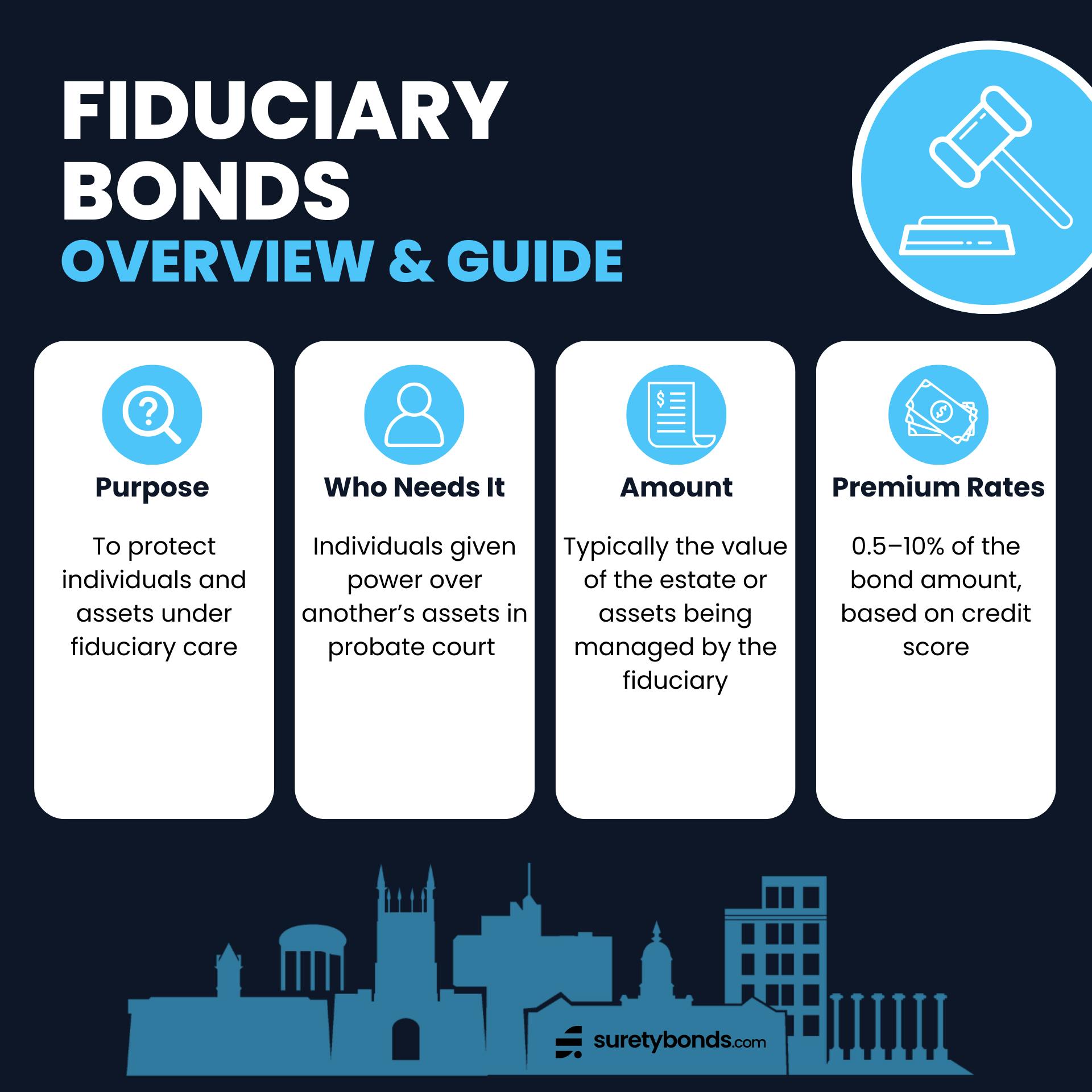

Fiduciary bonds protect heirs, beneficiaries, and creditors when another person is given authority over an estate. They are typically required by probate courts when someone passes away without a will or without naming an estate administrator. However, fiduciary bonds are also used to protect individuals under fiduciary care, such as custodianships or guardianships.

SuretyBonds.com is a leading provider of fiduciary bonds. We issue all types of fiduciary bonds for guardians, conservators, executors, administrators, personal representatives and more. Apply online today.

How Much Do Fiduciary Bonds Cost?

Fiduciary bond premium rates vary based on the value of the estate, which determines the total bond coverage the court will require. Typically, the first $250,000 of fiduciary bond coverage costs 0.5% of the penal sum. For example, a $150,000 bond at this rate would cost the fiduciary $750.

With larger estate sizes, fiduciary bond insurance becomes higher risk and pricing typically increases to 0.75–2% or more accordingly. Apply now for an exact quote.

How Long Do Fiduciary Bonds Last?

Fiduciary/probate bonds remain in effect until the fiduciary is released of their duties by the court. Typically, this means one or more of the following conditions are met:

- All debts and taxes are paid,

- Assets are distributed to all heirs/trustees

- A guardian/conservator is no longer necessary

The probate process can take anywhere from several months to several years. Rather than lasting a set time period, fiduciary bond terms are continuous until released. Once the court (the bond obligee) releases the obligation, the surety will cancel the bond policy.

When Is a Bond Required for Probate Court?

It is advisable for all state executors and administrators to get a probate/fiduciary bond. They are always required if the will or trust of the decedent specifies as such. In other cases, it may be up to the court to decide. For example, if the estate has significant debt, the probate court typically mandates bonding.

What Does Fiduciary Bond Insurance Cover?

Bonding financially incentivizes estate fiduciaries to comply with the will/trust terms. Surety bonds cover claims resulting from the following acts by a fiduciary:

- Intentional fraud, theft, embezzlement or commingling of funds

- Mismanagement, carelessness, accounting errors or other negligence

- Failure to comply with other probate court orders covered by the bond

In most cases, fiduciary bond insurance covers the total value of any non-real property assets under fiduciary control.

Who Benefits from a Fiduciary Bond?

A fiduciary bond protects heirs, beneficiaries, trustees and creditors from fraudulent fiduciaries. The surety company bonds the personal representative of the estate to guarantee their ability to pay any sums owed to the state and beneficiaries.

Are Fiduciary Bonds Refundable?

While the principal is responsible for purchasing the bond, fiduciaries can typically use the estate funds to reimburse the premium expense. This does not apply to any claims made against the bond.

How Do Fiduciary Bonds Differ From Other Surety Bonds?

Surety bonds are three-party contracts that ensure certain obligations are upheld. A fiduciary bond is a specific type of surety bond for individuals appointed fiduciary responsibilities by probate courts.

Fiduciary Bonds vs Fidelity Bonds

The terms fidelity bond and fiduciary bond are often interchanged. Both are surety bonds that work to protect individuals and their assets, but they are not the same.

A fiduciary bond contract holds an estate fiduciary liable to meeting specific court orders. A fidelity bond protects employers and individuals from losses incurred by dishonest employees.

Fiduciary Bonds vs ERISA Bonds

ERISA bonds are a unique type of fidelity bond that protect individuals who contribute to 401ks and other employee retirement plans. Fiduciary bonds are a type of probate court bond to protect beneficiaries of estates or individuals under guardianships/conservatorships.

Should I Waive the Fiduciary Bond Requirement?

Many jurisdictions mandate fiduciary bonds unless the requirement is specifically waived in the decedent’s will or trust. Waiving the fiduciary bond requirement can be quicker, cheaper and more convenient for the fiduciary. However, without a surety bond, the estate and its beneficiaries lack protections.