Reducing your surety bond cost can greatly benefit your bottom line. Whether you need a bond for licensing, construction projects, or other obligations, finding methods to lower your premium without sacrificing coverage is essential.

Read on to learn about the factors influencing bond premiums, assess risk factors, and explore strategies to qualify for more competitive rates.

What Are Typical Surety Bond Rates?

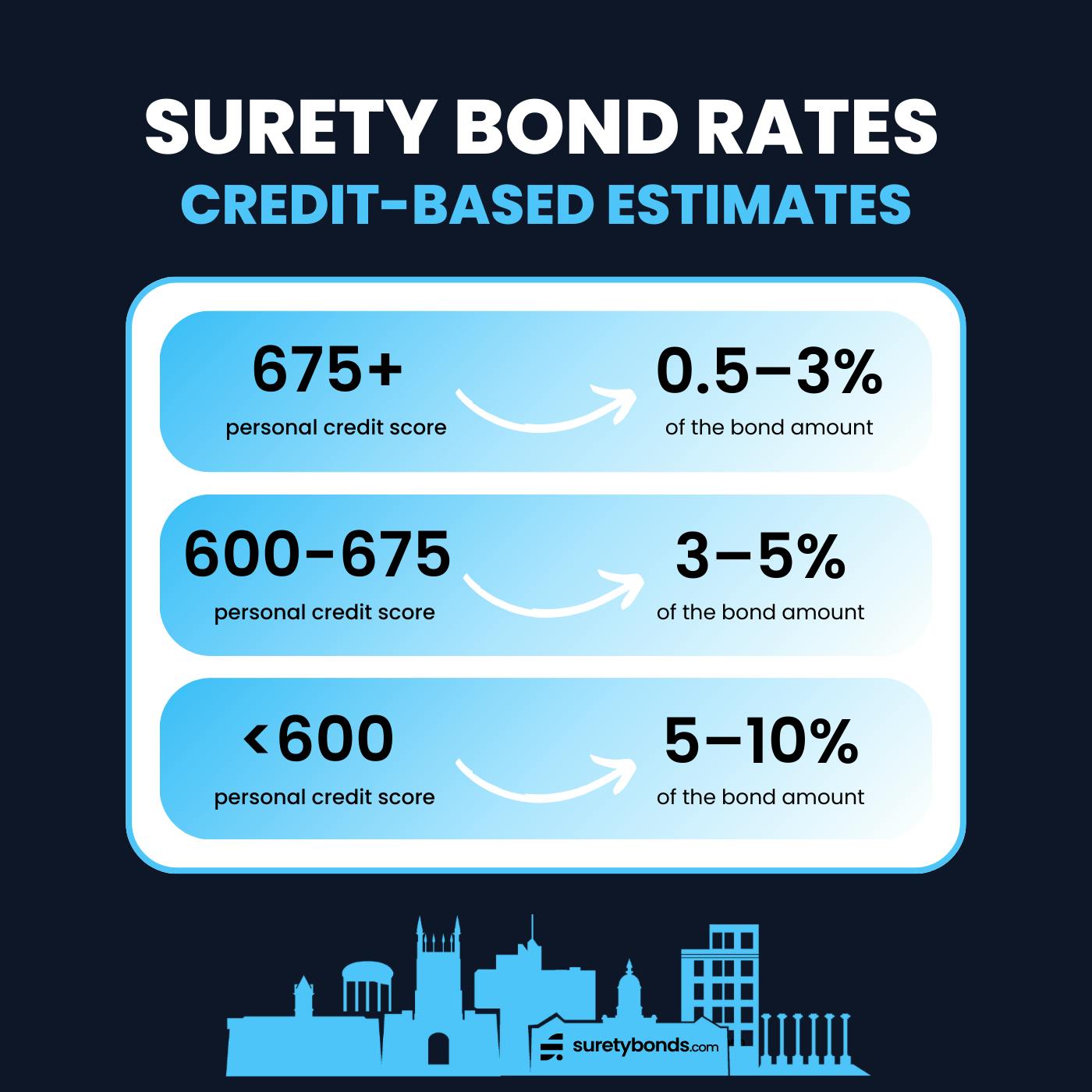

License and permit bonds are typically issued at 1–3% of the total bond coverage at standard market rates or 3–10% for bad credit bonding. However, bonds involving higher complexity and risk, like contract and court bonds, tend to command higher premiums.

How to Lower Your Surety Bond Cost

Surety underwriters look for evidence of financial capital, working capacity and moral character when pricing bonds. Follow these eight tips to set yourself up for the lowest available surety bond rates based on those criteria.

1. Improve credit score

Credit score is the main factor impacting surety bond rates. If low credit results in a high quote, consider these actions to restore your credit:

- Setting payment reminders

- Prioritizing debt payoff

- Checking credit report

- Diversifying your credit portfolio

- Consulting a credit counselor

While it won't happen overnight, improving your credit score can be achieved faster than anticipated with determination and effort.

2. Review and dispute any errors on your credit record

It's essential to regularly review your credit report to catch any mistakes that might be hurting your credit score. Addressing these issues promptly can help you maintain accurate financial information and improve your overall creditworthiness.

3. Establish industry credentials

Underwriters also often look for records of previous business ownership or experience. This is especially important for contractors and new business owners. Having several years of experience in your industry can demonstrate your ability to sustain a business.

Alternatively, a history of closing businesses, reopening under new names, excessive debt, or similar activity could lead to non-approval or a higher premium.

4. Use a financing plan

Even with good credit, the initial expense of a large surety bond can pose a challenge. Financing plans can help you launch your business or project by spreading out bond premium payments over time. Check out our premium financing page to learn more.

5. Provide strong financial statements

For larger surety bonds, underwriters look beyond personal credit to assess your business's financial health. Key financial statements include:

- Income Statement: Summarizes revenues and expenses over a year, showing long-term financial performance.

- Cash Flow Statement: Focuses on short-term income and expenses, indicating your business's liquidity.

- Balance Sheet: Details assets, liabilities and equity, providing a snapshot of your business's financial position.

Sometimes, these are required as part of the initial application. If not, you may be able to submit financial statements after applying to see if it results in a better quote.

6. Add a cosigner to your bond

If your credit score is low, you can request to include a cosigner on your bond. The bond rate will then be determined based on the combined credit scores of both you and your cosigner.

7. Work with a surety agency

Choosing the right surety bond provider is crucial for lowering your bond rate. At SuretyBonds.com, we partner with the top surety companies nationwide to match each applicant with the best available price on the market. Look for an agency or brokerage with strong market access, no added broker fees and a long-standing reputation.

8. Become a U.S. citizen

Becoming a U.S. citizen can lower your surety bond rate, but the process is intensive. Steps include filling out form N-400, passing English and civics tests, providing vital documents, and undergoing an interview with the U.S. Customs and Immigration Services.

How Do Surety Providers Calculate Bond Premiums?

Surety bonds are either instantly issued at a set price or require underwriting to quote each applicant. When you apply for a quote, underwriters may look at all six of the factors below to calculate your bond premium:

- Bond amount: Higher coverage bonds typically have higher premiums

- Bond type: Lower risk bonds have lower premiums

- Credit score: A strong credit score qualifies you for the best pricing

- Assets: Industry experience lowers risk for certain bonds

- Financial strength: Positive financial statements can lower your quote

- Experience: Asset ownership indicates lower financial risk

Calculate your estimated bond premium using our free cost calculator.

Get a Low Cost Surety Bond for Your Business

Secure a low-cost surety bond today at Suretybonds.com! We are the leading surety provider in the nation, offering the fastest and easiest bonding process. Apply today to experience our best-in-class service!