Securing a surety bond is often a crucial step for new business owners, but qualifying for one can be challenging in some industries. This page will help guide you through the key eligibility criteria, offer approval tips, and suggest alternatives if you run into any issues.

What to Do Before Applying for a Surety Bond?

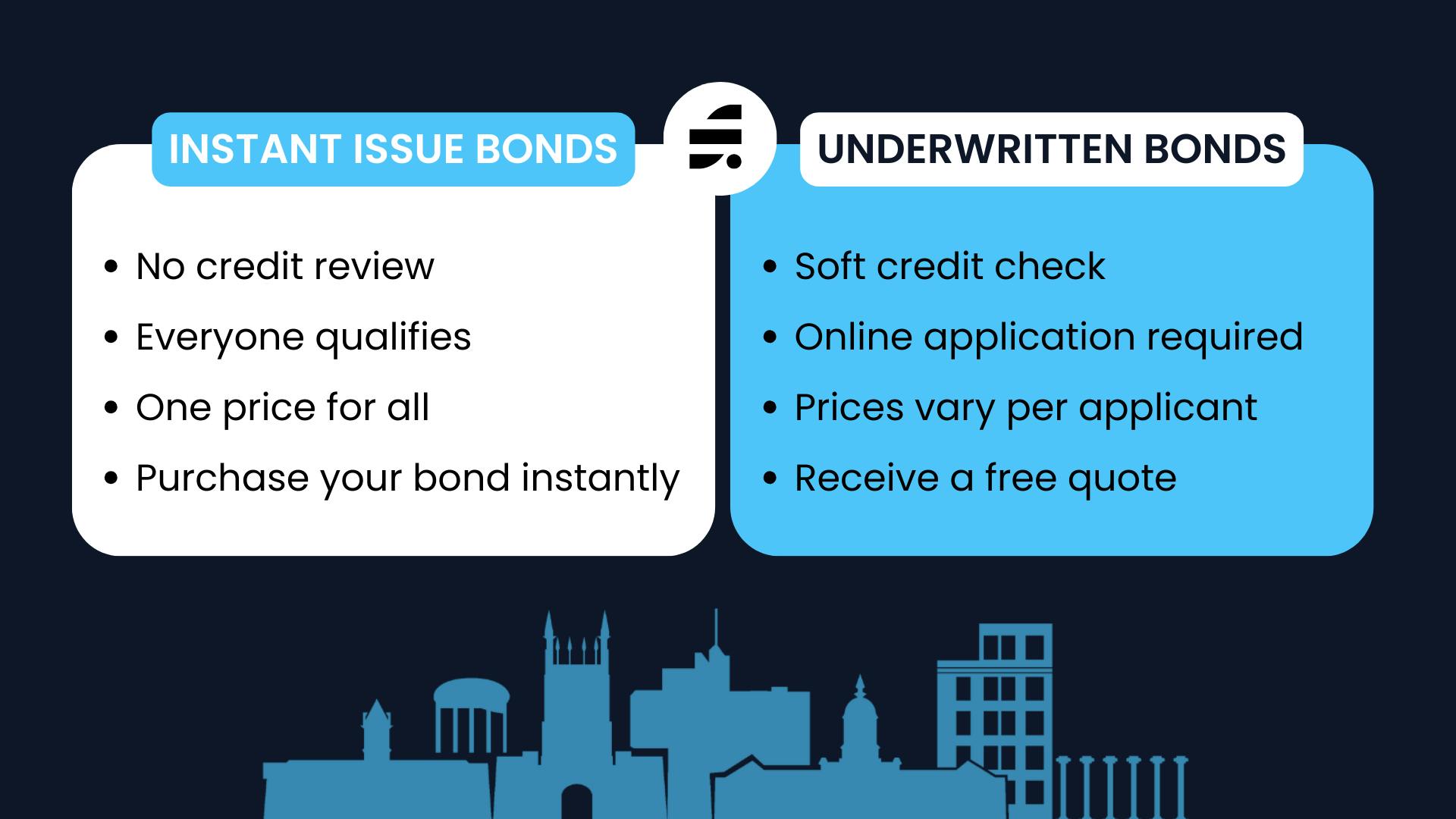

Before you apply for a surety bond, confirm the federal or local requirements for your industry to make sure you know the exact bond you need and the coverage amount. Then, find your bond on SuretyBonds.com and apply for a free quote. Depending on the bond, there are two application processes:

Instant Issue Applications

- Some bonds are available for instant issuance with no credit check. This means everyone qualifies and pays the same price. Applications typically only involve basic information necessary for the bond form.

Underwritten Applications

- Underwritten bonds require a soft credit check and may have specific eligibility requirements. Applications may involve additional questions or supporting documentation to determine the risk level for the surety.

Check out our surety underwriting guide to learn more about the process.

What Do I Need to Apply for a Surety Bond?

Most surety bond applications will need your official business name, address and ownership information. Some bonds require additional information such as:

- Credit score

- Personal financial statement

- Business financials

- Homeownership status

- Resume with industry experience

Further requirements vary between bonds as well as the state or even county you are in. Below is a brief breakdown of common documents needed for bond applications.

Applying for Construction Bonds

Exact details vary, but most construction bonds require the following documentation for underwriting:

- Scope of current projects

- Insurance certificate

- Number of employees

- Bank reference letter

Contractors may also be approved or denied based on their single limit or aggregate bond capacity. Apply for the bond you need in our Construction Bond Guide.

Applying for License and Permit Bonds

Many license and permit bonds are instantly issued with no qualifying factors. However, both underwritten and instant issue license bond applications often require standard business information, for example:

- Professional license number

- Business name/DBA

- Business location

- Business structure

- Other industry-specific details

If you're bonding a business, you'll need to provide information about ALL owners with 10% or more stake in the company. Use our License & Permit Bond Guide to find specific requirements for the bond you need.

Applying for Vehicle Title Bonds

Bonds for vehicles with missing or defective titles are always instantly issued. However, you need to know the exact bond coverage your DMV requires before purchasing. Applications will include the following:

- Your name (as it appears on your driver’s license)

- Address

- Vehicle year, make and model

- Vehicle identification number (VIN)

- Vehicle appraisal value (exact amount per your local DMV’s requirements)

SuretyBonds.com is licensed to issue title bonds in all 50 states. Learn more about how to get a bonded title.

Applying for Business Service Bonds

Business service and janitorial bond applications for service-based companies require the following information:

- Company name

- Company address

- Desired bond amount

- Number of employees

- The type of work your company performs

These bonds are also instantly issued. Apply now and get your bond in minutes!

Applying for Probate Bonds

There are various types of probate or fiduciary bonds for guardians, executors, estate administrators and more. Probate bond applications require different court documents and information based on the bond type, such as:

- Case number

- Obligee name and address

- Details about the court case and any disputes among heirs

- Name of the estate owner and date of death (if applicable)

- Complete list of estate’s assets (for administrator and executor bonds)

- Copy of the deceased’s will (for executor and administrator bonds)

- Documents detailing the person’s assets (for conservatorship bonds)

Learn more about probate bonds with our Probate and Estate Bond Guide

Need help applying? Give us a call at 1 (800) 308-4358 and our surety experts will be happy to help.

What If I Don’t Qualify for My Bond?

If you don’t qualify for your surety bond, review the eligibility criteria and talk with your provider to understand why you didn’t qualify. In some cases, a cosigner or additional documentation can help strengthen your application and increase chances of approval. You might also explore alternative collateral options, seek out different bonding companies, or work on improving your financials.

How to Avoid Surety Bond Denials

To avoid denial on your surety bond application, follow these steps:

- Maintain a strong financial profile: Establish credit and keep your personal and business accounts in good standing. This demonstrates trust and credibility to surety underwriters.

- Complete an accurate, thorough application: Provide detailed and precise information in your application to avoid delays and improve your chances of approval.

- Work with a reputable surety bond agent: Partner with an experienced and trustworthy surety bond agency who can guide you through the process and offer bad credit bonding options — like Suretybonds.com!

- Address issues promptly: Quickly resolve any problems or discrepancies that arise during the application process. Prompt action can prevent complications in securing your bond.

We work hard to help each applicant gets approved for the bond they need. With our bad credit bonding program, we approve 99% of applicants. SuretyBonds.com is also an approved provider for the SBA Small Business Guarantee Bond Program to help contractors qualify for payment and performance bonds.